By Charles Iorhemba Ode

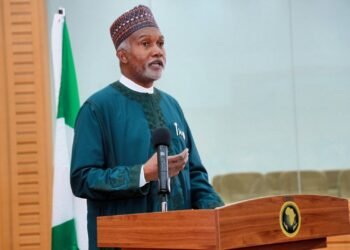

On Friday, 12th October, 2021 the Commonwealth Association of Tax Administrators (CATA) at its 15thgeneral meeting, elected Nigeria’s number one Taxman, the Executive Chairman of the Federal Inland Revenue Service (FIRS), Mr. Muhammad Nami as its fifteenth President. The forty-seven member country organisation voted overwhelmingly for Mr. Nami, who took over leadership from Mr. Sudhamo Lar, the Director General of Mauritius Revenue Authority as President of CATA.

Election of the President of CATA holds every three years, culminating the end of an incumbent’s tenure in office. This usually happens during a general meeting, alongside election into other positions such as Chairman of the Management Committee, Vice Chairman and Regional Directors.

The country that hosts the secretariat automatically fills the position of the Vice Chairman. Presently, the CATA secretariat is situated in Marlborough House, Pall Mall, London. This means the U.K. holds the Vice Chairmanship position. The position of Regional Director constitutes the Regional representatives who are elected at the 6 regions, namely: Asia, Europe, Canada & the Caribbeans, North Africa, Pacific and South Africa. The Management Committee is constituted by fourteen countries.

Another key position in CATA is that of the Executive Secretary. This is a full time employment contract. The individual is charged with the daily operations of CATA and sees to the smooth running of the secretariat. Unlike the position of President, Chairman, Vice Chairman and Regional Directors which are elective, the position of the Executive Secretary is done by appointment. The individual serves out a term of four years and could be reappointed based on satisfactory performance, however, by the discretion of the President in office at the time.

CATA is an Associated Organisation of the Commonwealth, established in 1978 by a decision of the Commonwealth Finance Ministers. Forty-seven Commonwealth countries are currently active members of CATA. The organisation helps member countries through conferences, training programmes, publications, and knowledge sharing to develop effective tax administrations that promote sustainable development and good governance. Its constitution provides that a general meeting holds every three years. The affairs of the Association are governed by the general meeting.

Nigeria is occupying the Presidency of CATA for the first time. This seems a daunting task but judging by the progressive reforms, repositioning and human development initiatives in the Federal Inland Revenue Service, orchestrated by Mr. Nami as the Executive Chairman, one is confident that he will bring it to bear positively on the global tax body, along with his decades of practical work experience as a tax professional. He stated this reassuringly in his acceptance speech.

With Nami at the helm of affairs at CATA, Nigeria also stands to gain from collaboration between member countries on several fronts. More information can be shared among member countries concerning new knowledge or innovative tax practices, which members can leverage on.

Illicit financial flow is denying developing countries revenue as being witnessed by way of capital flight and movement of money illegally acquired across borders. Members taking a stand against this and agreeing to implement strategic options that will checkmate the illegality would go a long way to safeguard revenues which would otherwise have been lost.

Nigeria will also leverage on opportunities for training and manpower development programmes organised by CATA. At least six training programmes occur annually in Commonwealth countries worldwide, besides the annual technical conference which also holds. The technical conference accords CATA members and non-members to rub minds, debate, exchange knowledge and ideas on current concerns to tax administration and policies globally.

Nigeria has an opportunity to enjoy from the Commonwealth income tax relief, which is available to members. However, member nations have to legislate it in their various countries before it can be implemented.

Nigeria is among the first twenty-seven (27) foundation members of CATA and it has been an active member till date. Despite the country’s active membership, the highest position it has ever attained is membership of the Management Committee. So, to have produced the President is a landmark achievement for history and posterity. And as President, Mr. Muhammad Nami seems poised to carve Nigeria’s name in gold in the annals of CATA.

“In a globalised environment where cross border activities have become the norm, it has become of vital importance that domestic revenue departments do not operate in isolation but work together with other foreign tax administrations. CATA has always served as an excellent forum where tax authorities from all over the world meet and share ideas and discuss problems. CATA’s selection of topics for the technical conferences have always been very relevant for the times.” (pg 38 of 40 years [1978-2018] commemorative magazine of the Commonwealth Association of Tax Administrators).

Testimonies of how member nations have leveraged to their advantage best practices and ideas shared at CATA technical sessions and training abound. Therefore, Nigeria’s Presidency of CATA surely has positive implications that would rub off on the country.

Charles Iorhemba Ode is a Media Practitioner based in Abuja-FCT