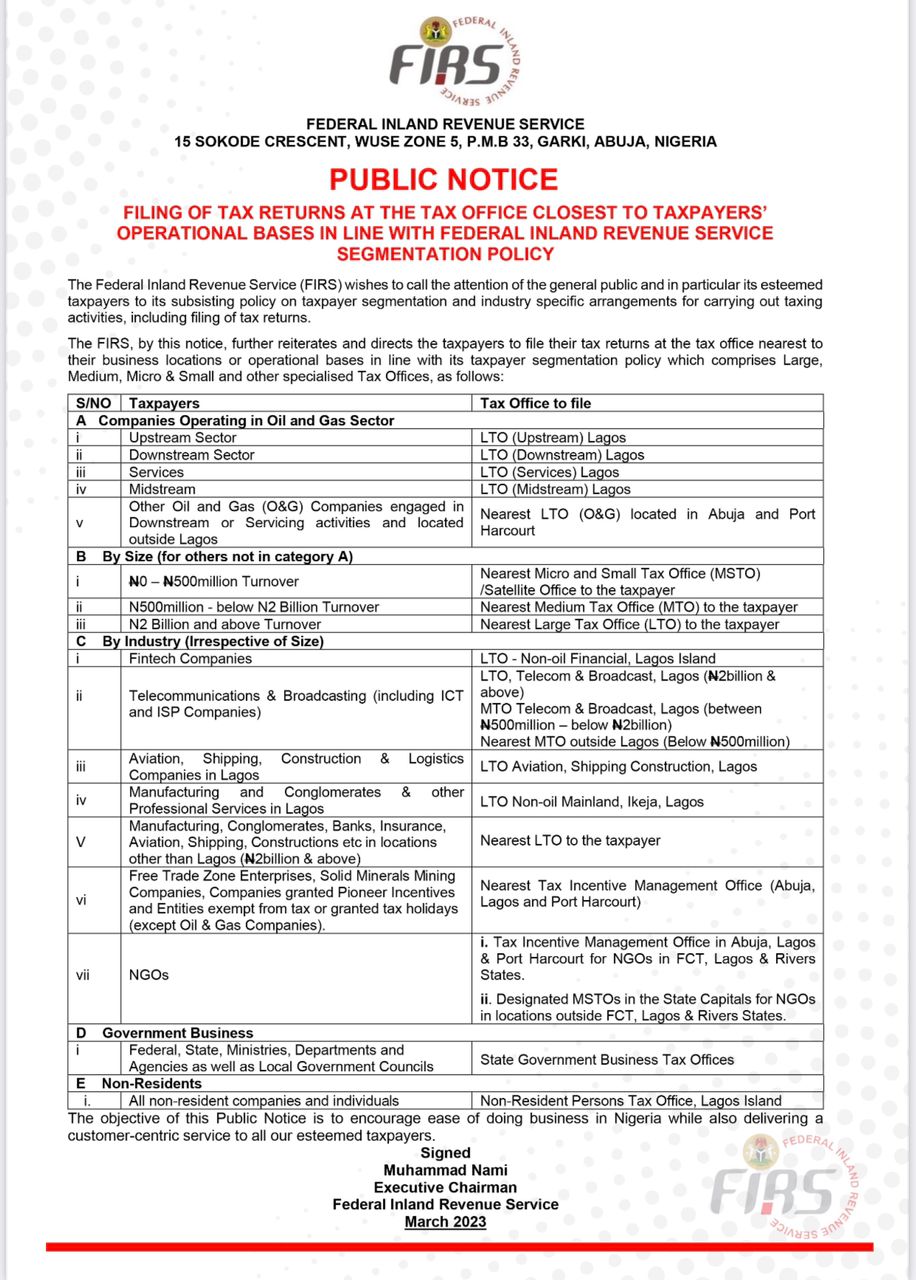

As the controversy over the collection of Value Added Tax (VAT) rages, a Senior Advocate of Nigeria (SAN), Chief Oba Maduabuchi, has said the provisions of the 1999 Constitution and the Value Added Tax Act which empowers the Federal Inland Revenue Services (FIRS) to collect VAT should be respected.

The controversy over the subject matter followed a judgment of a Federal High Court, Port Harcourt Division, held that the FIRS lacked the powers to impose and collect taxes that are not listed under items 58 and 59 of Part I of the Second Schedule of the 1999 Constitution (as amended).

But while the FIRS has appealed against the judgment at the Abuja division of the Court of Appeal, the Lagos State Government has filed a motion seeking to be joined in the litigation.

The FIRS is equally urging the National Assembly to amend the constitution by including VAT in the exclusive list and making tax an exclusive preserve of the federal government.

But speaking with Daily Sun on the matter, Chief Oba Maduabuchi (SAN), said the proper person or body to collect VAT is the Federal Inland Revenue Service.

Backing his position with the law, he added that both the provisions of the 1999 Constitution, the Value Added Tax Act and the Companies Income Tax Act, all recognized the FIRS as the proper body for the administering and management of VAT.

‘You know the grundnorm of Nigeria law is the constitution. It is supreme and any law that is inconsistent with the provisions of the constitution is to the extent of that inconsistent null and void.

‘Now, in the constitution, we have the exclusive legislative list, which is reserve exclusively for the National Assembly to legislate on. These are also things only the federal government can venture into. Then you have the concurrent legislative list. These are issues where either the state or federal government can legislate or act upon and then we have a residual legislative list, which is reserve exclusively for the states.

‘Once the Federal Government, the National Assembly has legislated upon an item in the concurrent legislative list, it transmutes into the exclusive list because no other person can now legislate upon it.

‘So in answering your question, what we need to ask ourselves is, under the constitution, is taxation and payment of taxes in the exclusive legislative list, the concurrent list or the residual legislative list?

‘The answer to that question is in Article 7 of the 1999 constitution which makes provisions for imposing taxes on capital gains, incomes, profit of the persons other than companies”, so it is on the concurrent list.

‘Now, all you need to ask yourself is, is there legislation by the National Assembly on taxes? Of course, the answer is yes, because we have the Value Added Tax (VAT) Act, No: 102 of 1993 and also No: 12 of 2007, which is an amendment.

‘So, if there is legislation by the National Assembly on the question of taxes and taxation, in that VAT Act, is there any provision as to who is to run our tax system? To answer this question, we still go back to the law.

‘By virtue of section 7 of the Value Added Tax Act, the Federal Board of Inland Revenue is responsible for the assessment and collection of VAT and shall account for all amounts collected in accordance with the provisions of the Act.

‘If you go back to the provisions of Article 7 of the concurrent legislative list, it tells you ‘capital gains, incomes and profits of persons other than companies’

‘So, companies are removed from the provisions of Article 7 of the 1999 constitution in the concurrent list. That is because there is specific legislation, the Companies Income Tax Act, which also authorised the FIRS to collect tax from companies. So, all these controversies, I don’t see the necessities for them. The proper person or body to collect VAT is the FIRS.

‘So far as the law is there validly made by the National Assembly, it will be daydreaming for us to begin to wish away the provisions of the VAC Act. If it is there, the provisions are extant and we shall be bound by it.’

On the request by the FIRS to the National Assembly to amend the constitution and place taxation on the exclusive list, the constitutional lawyer said it was not going to work.

‘If you put taxation in the exclusive legislation list, what it means is that states cannot collect taxes from people living in their domain. The state in general revenue service will become moribund.

‘Taxation can never go into the exclusive legislation list, it should remain in the concurrent list so that when the National Assembly makes legislation on taxes, as it pertains to the Federal Government and its revenue, the state governments will make legislation as it pertains to their revenue of the state.

‘There are things the National Assembly cannot legislate upon. You cannot for instance legislate on how to collect tax from my village market.’

Source: Sun Newsonline